El título V de MiCA recoge los procedimientos de notificación y autorización de los proveedores de servicios de criptoactivos así como las condiciones de ejercicio de su actividad.

Para poder prestar servicios de criptoactivos en la Unión Europea, quien los preste debe ser:

una persona jurídica u otra empresa que haya sido autorizada como proveedora de servicios de criptoactivos de conformidad con el artículo 63, o

una entidad de crédito, un depositario central de valores, una empresa de servicios de inversión, un organismo rector del mercado, una entidad de dinero electrónico, una sociedad de gestión de OICVM o un gestor de fondos de inversión alternativos, y esté autorizada a prestar servicios de criptoactivos en virtud del artículo 60.

Régimen transitorio El artículo 142.3 del Reglamento MiCA incluye la posibilidad de que los Estados miembros establezcan un periodo transitorio de hasta 18 meses.

España decidió aplicar este periodo transitorio, reduciéndolo a 12 meses (esta decisión fue comunicada formalmente a ESMA). Por lo tanto, el periodo transitorio en España finalizará el 30 de diciembre de 2025. PAe - España adelanta la aplicación del primer Reglamento del mundo sobre el mercado de criptoactivos

¿Quiénes podrán acogerse en España al periodo transitorio de 12 meses? Las entidades que podrán acogerse al periodo transitorio serán aquellas que vinieran prestando servicios de forma efectiva sobre criptoactivos antes de la aplicación de MiCA de acuerdo con la normativa nacional vigente.

Hasta la entrada en aplicación de MiCA, en España resultaba de aplicación la Ley 10/2010, de 28 de abril, sobre prevención del blanqueo de capitales y de la financiación del terrorismo. De acuerdo con esta Ley, el Banco de España mantiene, desde mayo de 2021, un registro en el que deben estar inscritas todas las entidades que presten servicios de cambio de moneda virtual por moneda fiduciaria y de custodia de monederos electrónicos.

Por tanto, las personas físicas y jurídicas que estuviesen inscritas en este registro a 30 de diciembre de 2024, podrán continuar prestando los mismos servicios que venían prestando hasta entonces, sin necesidad de solicitar autorización, hasta el día 30 de diciembre de 2025 o hasta la fecha en que se les deniegue la inscripción en el registro proveedores de servicios de criptoactivos regulado en el Reglamento MiCA, si esta fuera anterior.

Quienes estuviesen prestando otros servicios sobre criptoactivos diferentes a cambio de moneda virtual por moneda fiduciaria y de custodia de monederos electrónicos, ¿podrán acogerse al periodo transitorio?

Sí, aquellas personas físicas o jurídicas que prestaran exclusivamente otros servicios sobre criptoactivos diferentes a los recogidos en la Ley 10/2010, como serían la gestión de carteras o el asesoramiento y, por tanto, no pueden estar incluidos en el registro del Banco de España a estos efectos, podrán seguir prestándolos siempre que lo vinieran haciendo de manera efectiva.

¿Desaparece el Registro del Banco de España de proveedores de activos digitales?

No desaparece. A partir del 30 de diciembre de 2024 permanecerá a efectos informativos, si bien, no podrán inscribirse más personas físicas o jurídicas en el mismo. Registros de entidades - Banco de España

Los proveedores de servicios sobre criptoactivos de otros Estados miembros de la Unión Europea, ¿podrán prestar servicios en España?

Podrán prestar servicios en España siempre que hayan obtenido la autorización MiCA en un país miembro de la UE y hayan comunicado su intención de prestar servicios España.

Si estuvieran prestando servicios en su Estado miembro origen acogiéndose al periodo transitorio que ha establecido dicho país, no podrán hacerlo, salvo que también puedan acogerse al periodo transitorio de España. Hay que tener en cuenta que los periodos transitorios pueden ser diferentes en diferentes países o, incluso, puede haber países que no lo establezcan.

En el enlace que aparece a continuación, se encuentra la lista de las Autoridades Competentes designadas por cada Estado miembro para llevar a cabo las distintas funciones establecidas en el Reglamento.

Competent Authorities

Asimismo, ESMA ha publicado un listado con los periodos transitorios de los diferentes Estados miembros: List of grandfathering periods decided by Member States under MiCA

Otras publicaciones de interés:

ESMA ha publicado un documento para uso de las Autoridades Competentes con el fin de lograr un enfoque convergente en la UE para la autorización MICA. El Informe tiene por objeto ayudar a las Autoridades Competentes en la aplicación práctica de los requisitos del Reglamento sobre el mercado de criptoactivos (MiCA) a la autorización de proveedores de servicios de criptoactivos (CASP) y promover prácticas de autorización armonizadas en toda la Unión.

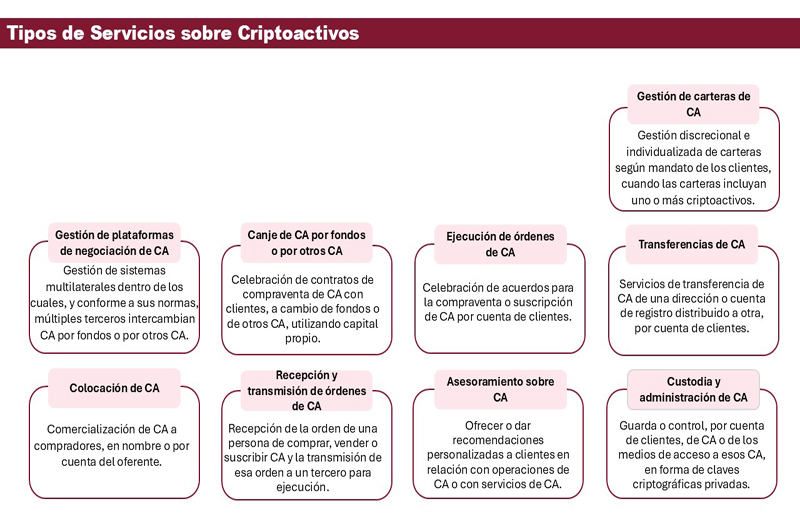

Tipos de servicios sobre criptoactivos

Proceso de autorización y notificación

Para poder llevar a cabo estos servicios los proveedores deberán solicitar una autorización o enviar una notificación en el caso de ser entidades financieras.

Con el objetivo de facilitar estos procesos la CNMV ha publicado los siguientes documentos:

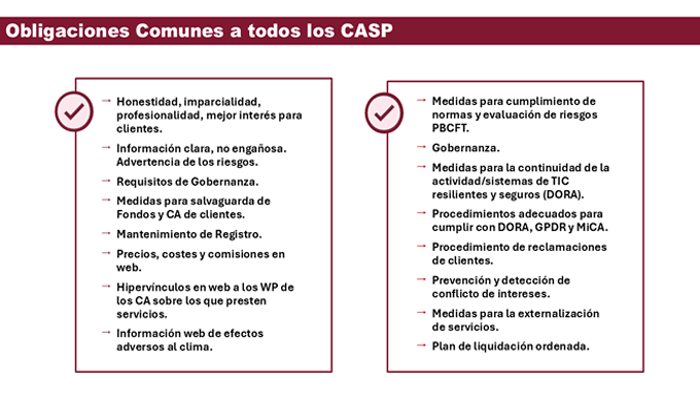

Obligaciones comunes a todos los proveedores de servicios de criptoactivos.

En el capítulo 2 del Reglamento MiCA se encuentran las obligaciones comunes a todos los proveedores de servicios de criptoactivos que se resumen a continuación.

La regulación también establece reglas específicas dependiendo de los servicios prestados. Estas se recogen en los artículos del 75 al 82 del Reglamento.

Listado de preguntas y respuestas de la AEVM

Adicionalmente, la AEVM ha publicado un listado de preguntas y respuestas en relación con los proveedores de servicios de criptoactivos. El detalle de las preguntas y respuestas se encuentra en el siguiente enlace: Search a question | European Securities and Markets Authority